To those building beyond the status quo, our friends and supporters:

We founded Next Wave Partners three years ago because we could no longer play along with venture capital's collective delusion. While the evidence of the industry's failure mounted—in disillusioned founders, frustrated investors, and missed opportunities—the celebration of mediocrity only grew louder. We believed then, as we do now, that venture capital needs more than gentle reform. It needs a complete reinvention.

Our first annual letter marks an important milestone on our long journey to build a new model. It's an opportunity to share not just our progress but our deepening conviction that the future of venture capital will look radically different from its past. What follows is a diagnosis of where venture capital has lost its way and a detailed blueprint for how we're working to set it right.

The Venture Capital Paradox

The venture capital ecosystem has reached a critical inflection point. In 2024, while 1,550 active unicorns collectively represented $5.2 trillion in value, new unicorn formation dropped dramatically to just 102 companies, down from 629 in 2021. This deceleration reflects more profound systemic challenges that now demand attention.

The numbers reveal a troubling disconnect. According to Pitchbook, total venture capital deployed reached $209B in 2024, but over 70% went to follow-on rounds in existing portfolio companies rather than new investments. The industry is effectively eating its own tail - pouring more capital into aging unicorns while choking off the formation of new companies. The average time to exit has stretched to 8.1 years, up from 5.3 years a decade ago. Meanwhile, seed and early-stage deals have dropped by 41% since 2021, even as fund sizes have grown larger.

This paradox - mounting paper wealth alongside declining dynamism - signals a fundamental breakdown in venture capital's core function: funding innovation. Instead of allocating capital to the most promising new ventures, the industry has become a mechanism for concentrating wealth in an aging portfolio of increasingly illiquid companies. For founders and early investors, this creates an impossible choice between accepting unfavorable terms to participate in later rounds or watching their ownership get progressively diluted.

The Rise of the VC Cartel

The VC industry, long celebrated as a champion of entrepreneurial spirit, is now dominated by a small cohort of firms wielding disproportionate influence. According to Pitchbook, just nine venture capital firms captured almost half of all U.S. fundraising in 2024, with the top 30 collectively raising 75% of the year's capital. The median VC fund size has stagnated at $24.8M while the average has swelled to $190M. Meanwhile, smaller and emerging managers struggle, capturing a mere 14% of new commitments.

This consolidation has transformed the ecosystem into what increasingly resembles a cartel, where access to deal flow, capital, and valuation control is concentrated in a privileged few. These dominant firms aren't just getting bigger—they're systematically squeezing out competition.

The cartel structure manifests a form of modern feudalism. Without the right connections in Silicon Valley—the right schools, zip codes, Patagonia vests—promising startups find themselves cut off from growth capital. Unlike public markets, where competition ensures price discovery and accountability, the cartel sets opaque valuations through pseudo-priced rounds and imposes predatory terms that squeeze out smaller, earlier investors.

The Unicorn Problem

At the heart of venture capital's dysfunction lies what we term "The Unicorn Problem". This problem manifests upstream, where the cartel's gatekeeping strangles deal flow, and downstream, where their unicorn obsession traps capital and forces unsustainable growth.

The Upstream Problem: Deal Flow

The venture ecosystem doesn't just favor the cartel - it systematically narrows innovation and creates destructive herd behavior. Here's how:

Cartel firms naturally see the most promising deals first, through their extensive networks, accelerator relationships, and university pipelines. But rather than fostering diversity of thought, this concentrates capital and attention on an increasingly narrow set of ideas, industries, and business models. The result? A venture ecosystem that chases the same deals, copies the same playbooks, and funds the same types of founders.

This conformity cascade is particularly damaging because of venture capital's powerful signaling effects. When major firms pass on deals outside their narrow focus areas, they don't just reject individual companies - they effectively mark entire sectors and approaches as "unfundable." Promising founders working on novel solutions either conform to the consensus view or abandon their fundraising entirely. Meanwhile, other investors, from smaller VC and seed funds to family offices, feel pressure to mirror the investment theses of top firms rather than develop differentiated strategies.

The result is a tragic stagnation: rather than funding diverse approaches to hard problems, the industry crowds into consensus deals and "hot" sectors. True innovation - the kind that comes from unexpected places and challenges conventional wisdom - struggles to find capital. We're left with an ecosystem that efficiently funds slight variations on proven models while systematically strangling novel approaches and contrarian thinking.

The Downstream Trap: Unicorn Chasing

Even when independent investors find promising deals, the unicorn problem creates a second set of challenges. Over 40% of U.S. unicorns have been trapped in portfolios for over nine years with no path to liquidity. This isn't just a statistic - it represents thousands of independent investors whose capital is indefinitely locked up in companies that may never deliver returns.

For independent investors, this creates three compounding problems:

First, portfolio companies that gain traction get funneled into the cartel's predetermined growth paths. We've watched countless promising startups shift their entire strategy to chase unicorn status, abandoning sustainable growth models that could have delivered strong returns to early investors. The result? Independent investors lose control over their portfolio companies' destinies.

Second, it creates a capital bottleneck that hurts both investors and founders. When companies orient themselves toward unicorn trajectories, they become dependent on massive funding rounds that only the cartel can provide. This manufactured scarcity of growth capital forces founders to accept increasingly predatory terms. For early investors, this means watching your ownership get brutally diluted through multiple down rounds and structured financings that protect late-stage investors at your expense.

Third, and perhaps most perniciously, it distorts investment behavior across the entire ecosystem. Independent investors, seeing their best companies get captured by the cartel, begin mimicking cartel behavior. They chase the same hyper-growth metrics, apply the same inflated valuations, and push their portfolio companies toward unsustainable paths - all in hopes of attracting cartel attention. This creates a vicious cycle where even investors who recognize the problem feel compelled to participate in it.

The consequences ripple throughout the innovation economy:

For Angels, Smaller VC and Seed Funds, and Family Offices:

- Deal flow gets artificially constrained through cartel gatekeeping and signaling

- Early ownership positions get progressively diluted by cartel-controlled growth rounds

- Portfolio companies are forced onto unsustainable "unicorn or bust" trajectories

- Investment timelines stretch indefinitely as exits become increasingly rare

- Portfolio construction becomes distorted as viable deals get artificially limited

- Returns concentrate in fewer deals as the cartel controls access to growth capital

For Portfolio Companies:

- Early rejection by major firms creates a lasting stigma

- Forced to chase growth metrics that may not align with business fundamentals

- Become dependent on cartel funding for survival

- Face increasing pressure to maintain unsustainable growth

For the Innovation Ecosystem:

- Promising companies get prematurely filtered out

- Sustainable business models get overlooked in favor of growth stories

- Regional innovation hubs struggle to develop without cartel presence

- Diverse founding teams face additional barriers to capital access

This system isn't just inequitable - it's inefficient. While the cartel celebrates paper valuations and shapes market signals, countless promising companies with sustainable business models struggle to access any capital at all. Independent investors, who historically played a crucial role in funding innovation, are increasingly marginalized in an ecosystem they helped build.

The solution isn't to abandon high-growth venture investing - it's to rebuild venture capital around aligned incentives and sustainable returns.

Breaking the Cycle: The Next Wave Approach

History offers clear lessons for confronting entrenched financial power. When robber barons dominated American industry in the late 19th century, smaller entrepreneurs found innovative ways to compete and thrive. Farmers formed agricultural cooperatives, pooling resources to build shared infrastructure. Regional railroad alliances created expanded networks to challenge larger monopolies. These successes demonstrated that strategic innovation and collective action could overcome seemingly unshakeable economic control.

At Next Wave Partners, we're implementing a comprehensive strategy to restore balance, transparency, and opportunity to the venture capital market. Our approach centers on four key initiatives:

1. The Safer: Creating Sustainable Liquidity

The venture capital model is built on a myth: that exponential returns through exits justify indefinite illiquidity. The reality? Over the last twenty years, most venture outcomes have been acquisitions or PE buyouts, often structured to favor the cartel's later-stage positions. Even successful companies get trapped in an endless cycle of funding rounds, each diluting early investors while concentrating power in the hands of growth-stage investors who control the path to liquidity.

This broken model ignores a fundamental truth: a company's value lies in its future cash flows. The cartel's obsession with exponential exits has created a system where investors exchange real money today for the possibility of liquidity tomorrow - liquidity that the cartel controls and often denies to early investors.

The Safer (Simple Agreement for Future Equity with Repurchase) attacks this problem at its core. Building on Y Combinator's Safe - the only real financial innovation in venture capital in the last two decades - we've added an automatic revenue-based repurchase mechanism that creates predictable returns and real liquidity for early investors.

How it works

- Like a traditional Safe, the Safer converts to equity in a qualified financing

- Unlike a Safe, it includes a revenue-linked repurchase right that activates as the company scales

- This creates a contractual claim on future cash flows, providing liquidity without forcing an exit

- Companies can repurchase Safer holders' stakes at predetermined multiples based on revenue milestones

- Early investors get sustainable returns without relying on the cartel's mercy for liquidity

The implications are revolutionary:

- Investors can achieve venture-scale returns through cash flows, not just exits

- Companies can grow sustainably without constant pressure to chase unicorn valuations

- Early shareholders can get liquidity without waiting for cartel-controlled exits

- The ecosystem can develop around predictable, revenue-linked instruments

Developed in partnership with law firm Polsinelli and stress-tested with leading tax and accounting firms, we've open-sourced the Safer under a Creative Commons license to ensure its accessibility to all. The response confirms the market's hunger for liquidity alternatives:

- Thousands of downloads across the startup ecosystem

- Significant adoption in early-stage deals

- Growing recognition from both investors and founders

- Comprehensive documentation and implementation guides

The Safer isn't just another financing instrument - it's a direct challenge to the cartel's control over venture liquidity. By creating predictable paths to returns that don't depend on cartel cooperation, we're building a more sustainable model for early-stage investment, one deal at a time.

2. The Next Wave Network: Democratizing Access

The venture capital cartel maintains its power through artificial scarcity of information and access. While we could have launched another fund, our vision is more ambitious: to create a movement that fundamentally reshapes how independent investors access and win in venture capital.

Today, we're proud to announce the Next Wave Network, a powerful alliance of independent investors fighting back against cartel dominance. The Network isn't just a platform - it's an ecosystem designed to give independent investors the collective leverage they've never had:

Institutional-Grade Research Without Institutional Costs

- Most independent investors and smaller VCs can't afford the $50,000+ annual subscriptions or dedicated staff for quality venture research

- Our research team provides deep industry analysis, technical assessments, and company research

- Members receive detailed reports on emerging sectors, technology shifts, and market opportunities

- All research is shared simultaneously with all members - no more information asymmetry

Deal Flow That Matters

- We don't just pass along deals - we put our own capital and reputation behind them

- Every opportunity comes from our venture studio, where we work directly with founders

- Members see the same deals, same terms, and same information as everyone else

- All deals structured with our Safer instrument to ensure aligned incentives

Collective Due Diligence

- Members pool their expertise and networks for deeper company evaluation

- Shared access to technical experts, market specialists, and domain authorities

- Collaborative deal review sessions with experienced investors

- No more flying blind on technical assessments or market sizing

Incentive Alignment

- No more “2 and 20” fee structure so every dollar focuses on value creation

- Safer instrument ensures all stakeholders benefit only from success

- Eliminates incentives to chase inflated valuations and prioritizes lasting value

True Transparency

- Full visibility into deal terms, cap tables, and founder communications

- Regular portfolio company updates and performance metrics

- Direct access to founding teams for member questions

Collective Power

- Network members collectively represent significant capital

- Ability to lead or fill entire rounds without VC participation

- Shared term sheet standards that protect investor interests

- Shared resources for portfolio company development

- Collective introductions and business development

- No more passive capital hoping for exits

Our model is simple: members pay a reasonable annual subscription that funds our research team and operating platform. In return, they get:

- Regular deep-dive research reports on emerging sectors and technology

- Deal opportunities from our venture studio

- Member summits for direct collaboration

- Ongoing access to our deal platform and investment opportunities

Every new member strengthens our collective ability to:

- Source exceptional deals outside existing channels

- Win competitive rounds through group participation

- Access institutional-quality research and analysis

- Build sustainable companies focused on real value creation

The Next Wave Network represents a fundamentally different approach to venture capital, one built on aligned incentives, shared information, and collective action. We invite accredited investors to join us.

Join the Next Wave Network

For accredited investors who want to shape the next technological revolution.

Get Started3. Our Focus: The Era of Autonomy

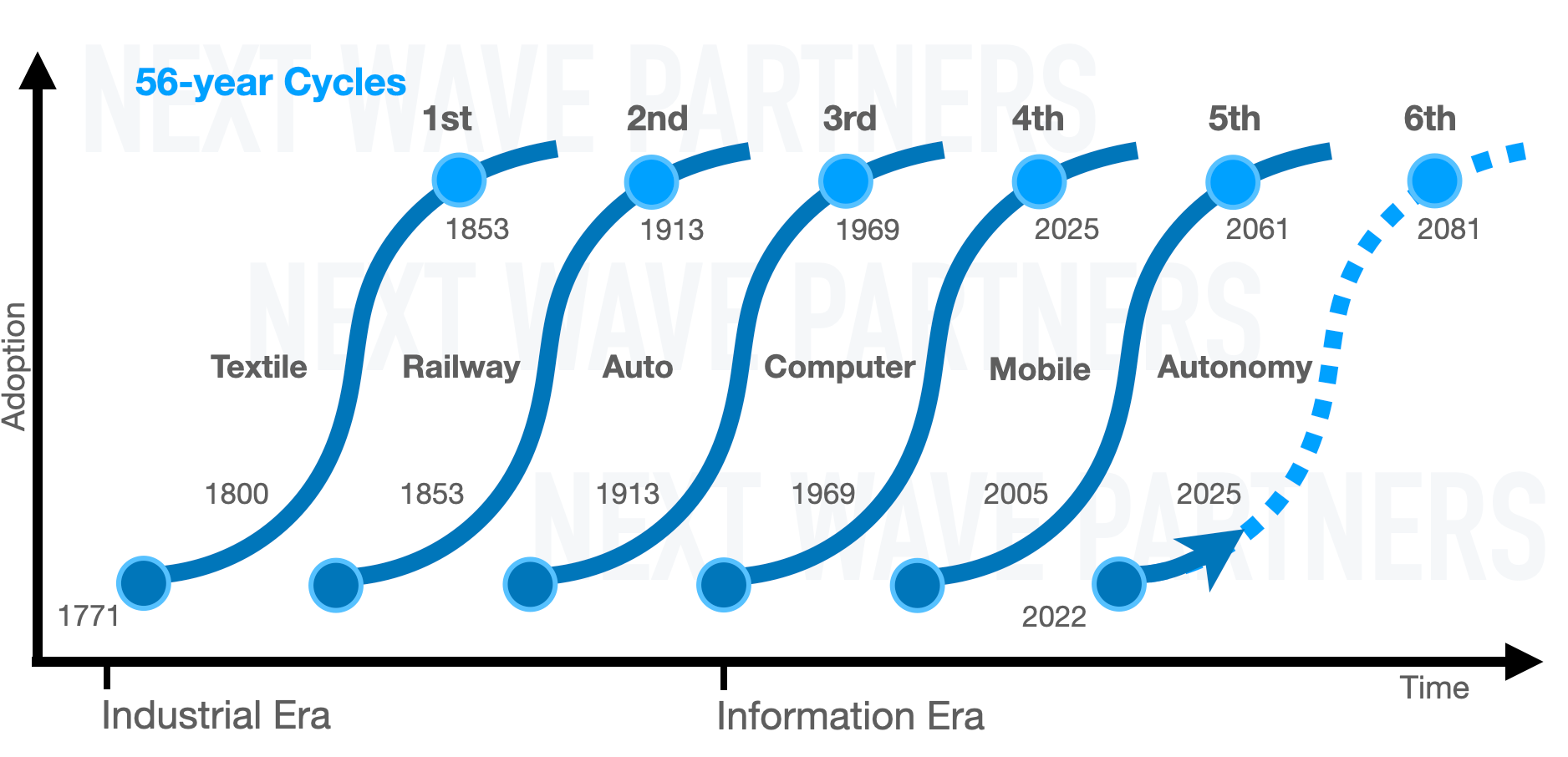

We stand at the dawn of the sixth long wave of innovation: the Era of Autonomy. This represents more than just an incremental advance in technology—it marks a fundamental shift in how machines interact with the physical world and each other, creating unprecedented opportunities for value creation and societal transformation.

Understanding Long Waves

The concept of technological long waves, first introduced by economist Nikolai Kondratieff and later developed by Joseph Schumpeter, suggests that major technological revolutions occur in predictable cycles of approximately 50-60 years. Each wave brings fundamental changes to the economy and society through clusters of breakthrough innovations:

- First Wave (1780s-1830s): Steam power and early mechanization

- Second Wave (1830s-1880s): Railways and mass transportation

- Third Wave (1880s-1930s): Electricity and heavy engineering

- Fourth Wave (1930s-1970s): Mass production and petrochemicals

- Fifth Wave (1970s-2020s): Information technology and telecommunications

These waves aren't merely about technological advancement—they represent complete transformations of the techno-economic paradigm, reshaping how value is created and distributed throughout society.

The Sixth Wave: Era of Autonomy

Today, we're witnessing the emergence of the sixth technological long wave. This new era is characterized by:

Convergence of Physical and Digital Realms

- Integration of AI with physical systems

- Autonomous decision-making capabilities

- Real-time sensing and response

- Edge computing and distributed intelligence

Machine-to-Machine Commerce

- Autonomous economic agents

- Self-organizing supply chains

- Automated value exchange

- Intelligent resource allocation

Intelligent Infrastructure

- Smart cities and transportation systems

- Adaptive energy grids

- Autonomous industrial facilities

- Integrated healthcare systems

This wave is unique in its potential to create self-reinforcing cycles of innovation and economic activity. Unlike previous waves that primarily augmented human capabilities, the Era of Autonomy enables systems to operate, decide, and trade autonomously, creating entirely new markets and economic models.

Investment Implications

Building on Schumpeter's work, researcher Carlota Perez developed a framework that reveals how every technological revolution follows a predictable pattern across two main periods, separated by a crucial turning point:

The Installation Period (20-30 years)

First comes Irruption, where new technologies emerge and challenge existing systems. Early adopters experiment while traditional players dismiss the change. Then comes Frenzy, where financial capital floods in, driving rapid expansion and speculation. This creates bubbles, funds massive infrastructure buildout, and typically ends in a financial crisis.

The Turning Point (2-10 years)

A period of reconfiguration where speculative capital gives way to productive investment. Institutional frameworks adapt, regulations emerge, and the true winners become clear. This separates the Installation Period from what follows.

The Deployment Period (20-30 years)

Starting with Synergy, where the technology becomes mainstream and benefits spread widely through society. Focus shifts from raw technology to practical applications. Eventually reaching Maturity, where the technology becomes standardized and ubiquitous, often as the seeds of the next revolution appear.

This pattern played out consistently across every technological revolution:

- Railways (1829): Railway mania → 1847 crisis → Victorian boom

- Mass Production (1908): Roaring Twenties → 1929 crash → Post-war golden age

- Information Tech (1971): Dot-com bubble → 2000 crash → Mobile/cloud revolution

Perez's framework suggests we should expect:

- A sustained period (5-10 years) of explosive experimentation in autonomous systems, marked by:

- Rapid technological breakthroughs in robotics, sensing, and machine intelligence

- High-profile successes alongside spectacular failures

- Intense competition between new approaches and traditional solutions

- Heavy investment in physical and computational infrastructure

- Growing tension between:

- Financial markets (demanding quick returns) and technological reality (requiring patient capital)

- Early adopters (embracing autonomous systems) and incumbents (defending traditional approaches)

- Public excitement about possibilities and fear about implications

- Eventually, a classic Frenzy phase where:

- Speculative capital floods into autonomous technology companies

- Valuations become increasingly disconnected from fundamentals

- Infrastructure buildout accelerates dramatically

- Market rewards bold promises over sustainable execution

This pattern suggests the greatest opportunities will emerge from:

- Building fundamental infrastructure for autonomous systems

- Focusing on real capabilities over speculative promises

- Maintaining discipline while others chase unsustainable growth

- Positioning for the long-term transformation while others seek quick exits

New Report: 2025 Autonomy and Machine Economy Opportunities

For Next Wave subscribers only: Dive in to our new 2025 Autonomy and the Machine Economy Opportunities report just released.

This 150-page report is full of in-depth analysis of the entire autonomy landscape, highlighting transformative technologies, market opportunities, and industry insights. This is your comprehensive guide to understanding and capitalizing on how the autonomy wave will reshape our world.

Opportunities

With this theoretical foundation in mind, we've identified eight key segments that we believe will define this transformative era:

Aerospace and Defense Systems

Autonomous systems focused on restoring strategic advantages and creating resilient security capabilities through unmanned aerial vehicles, autonomous naval systems, and space-based platforms. These innovations drive advances in sensing, navigation, and autonomous decision-making while addressing crucial national security objectives.

Computational Infrastructure

A critical technological ecosystem integrating advanced computational and networking technologies with AI capabilities to create adaptive, resilient physical computing environments. This encompasses data centers, edge computing, complex server networks, and sophisticated storage systems enhanced by large language models and intelligent software orchestration.

Consumer Robotics

Intelligent, autonomous systems designed to streamline daily household and personal tasks. These "Chore Bots" combine advanced robotics, AI, and user-centric design to perform routine domestic activities with increasing sophistication, transforming how individuals interact with their immediate physical spaces.

Hyperlogistics

A fundamental reimagining of goods movement and management through advanced robotics and intelligent systems. This creates adaptive supply chains and manufacturing processes capable of real-time optimization, enabling unprecedented efficiency in complex workflows while building more resilient industrial operations.

Hypermobility

Transportation transformation through advanced mobility systems that prioritize human movement across urban and long-distance networks. By integrating materials engineering, AI, and networked design, these systems create infrastructure that dynamically adapts to passenger needs while optimizing energy consumption.

Hazardous Environment Robotics

Specialized autonomous systems designed for extreme conditions where human presence is dangerous or impossible. These robots excel in precision, remote operation, and reliability, supporting applications from deep-sea exploration to nuclear decontamination and disaster response.

Humanoid Robotics

The most ambitious frontier in autonomous systems, integrating artificial intelligence with sophisticated physical capabilities for dynamic human and environmental interaction. These platforms drive innovations in human-machine interaction while enabling autonomous capabilities across multiple applications.

Medical Robotics and Precision Healthcare

Revolutionary integration of advanced robotics and imaging systems enabling minimally invasive surgeries, precision therapies, and improved patient outcomes. The convergence of AI with medical imaging and robotics transforms everything from diagnostic procedures to complex surgical operations.

4. Our First Investments

Today, we’re proud to announce our first two investments that exemplify our thesis:

CronAI: Redefining 3D Perception

CronAI makes machines intelligent with groundbreaking 3D perception technology leveraging an edge-first platform that delivers sub-10ms latency and 250m range detection:

- Edge-first design reducing latency and computational overhead

- Proprietary FLIP and DARWIN technologies for robust performance

- Scalable, privacy-preserving architecture

- Applications across autonomous systems and smart infrastructure

For Next Wave subscribers only: Read our in depth report on Cron AI USA, Inc.

Tubular Network: Revolutionizing Urban Logistics

Autonomous logistics platform transforms short-haul transportation with speeds up to 60x faster than traditional methods:

- AI-directed electric shuttles in underground tube networks

- Sustainable and efficient urban goods movement

- Scalable from campus networks to city-wide systems

- Integration with existing infrastructure

For Next Wave subscribers only: Read our in depth report on Tubular Network Inc.

The Path Forward

As we enter 2025, the venture capital industry shows many signs of what Perez describes as the "frenzy" phase of a technological revolution. While others chase speculative gains in cryptocurrencies and AI startups, we remain focused on building foundational technologies that will drive long-term societal and economic transformation.

We approach the current market dynamics with measured skepticism, focusing on opportunities rooted in the physical-digital confluence that require:

- Patient capital

- Deep technical expertise

- Long-term value creation

- Sustainable business models

- Real-world impact

Our mission extends beyond investment returns. We aim to restore venture capital to its original purpose: fueling innovations that create enduring value for society. By fostering collaboration, promoting responsible investing, and maintaining a long-term vision, we're positioning ourselves to lead in the deployment phase of this technological revolution.

We invite you to join us in this mission to reshape venture capital for the next generation of entrepreneurs and investors. Together, we can build an ecosystem that prioritizes sustainable growth, aligned incentives, and meaningful innovation.

-Next Wave Partners

Important Legal Disclosures

This memo is published by Next Wave Partners LLC (“Next Wave”), a Nevada limited liability company, for general informational purposes only and is not intended to be, nor should it be construed as, investment advice, an offer to sell securities, or a solicitation of an offer to buy securities, nor does it establish a client or fiduciary relationship. Next Wave is not a registered investment adviser or broker-dealer.

The content herein is provided “as is” and “as available,” and Next Wave makes no representation or warranty, express or implied, regarding the accuracy, completeness, or reliability of any information, including data obtained from third-party sources. All statements and opinions in this memo reflect Next Wave’s views and opinions as of the publication date and should not be construed as statements of fact. Next Wave utilizes artificial intelligence and other third-party data sources to prepare this content, which may introduce errors or biases. We disclaim any obligation to update or revise the information after publication.

Any private investment opportunities referenced herein are offered solely through formal offering documents to accredited investors, in compliance with applicable securities laws, and facilitated by registered broker-dealers or funding portals.

Next Wave, its partners, staff, and affiliates may hold positions, including equity, warrants, or options, in private or public companies discussed in this memo. These positions are subject to change at any time without notice, and Next Wave may derive financial benefit from them. Any mention of specific companies is for illustrative purposes and should not be construed as a recommendation or endorsement. Any reference to public securities is incidental and should not be interpreted as a recommendation for trading or investment.

Past performance is not indicative of future results. All investments, particularly private placements, involve significant risks, including the loss of principal. Readers must consult their own financial, legal, and tax advisors before making any investment decisions.

Certain statements in this memo may be forward-looking in nature, and actual results may differ materially from those expressed or implied. Links to third-party platforms, including but not limited to AngelList and EquityShift, are provided solely for convenience and do not signify endorsement by Next Wave, nor does Next Wave assume responsibility for any information contained on third-party sites.

Under no circumstances shall Next Wave, its partners, staff, or affiliates be liable for any losses or damages arising out of or in connection with the use of or reliance upon any information contained in this memo.Next Wave reserves the right to amend or modify these disclaimers at any time.

© 2025 Next Wave Partners LLC. All rights reserved.