1.0. Introduction

We stand at the threshold of perhaps the most significant technological transformation in human history - the emergence of the Machine Economy. This new economic paradigm, enabled by the convergence of autonomous systems, intelligent infrastructure, and machine-to-machine commerce, represents the culmination of what we call the Era of Autonomy. Unlike previous technological waves that primarily augmented human capabilities, this transformation will create truly independent machine actors capable of sensing, deciding, and engaging in direct economic activity with other machines.

The implications of this shift are profound. Throughout history, transformative technological innovations have arrived in distinct waves, fundamentally reshaping society and creating unprecedented economic value. From steam power to the internet, each wave has built upon its predecessors, unlocking new capabilities that redefine industries and create entirely new ones. Today, we believe the Machine Economy represents the most ambitious and forward-looking technological vision yet - one that will reshape not just how machines operate, but how they interact, trade, and create value autonomously.

This vision is being realized through the convergence of three revolutionary forces: autonomous systems that can operate independently in the physical world, intelligent infrastructure that enables machine-to-machine interaction, and new frameworks for machine commerce that allow autonomous systems to engage in direct economic activity. Together, these forces are creating the foundation for a new economic paradigm where machines become not just tools, but active participants in value creation.

In this report, we examine eight key domains that we believe will form the building blocks of the Machine Economy: Aerospace and Defense Systems, Computational Infrastructure, Consumer Robotics, Hyperlogistics, Hypermobility, Hazardous Environment Robotics, Humanoid Robotics, and Medical Robotics and Precision Healthcare. Each of these sectors represents a critical frontier where autonomous technologies are not just enhancing existing processes but enabling entirely new possibilities that will contribute to the broader machine economy.

Our analysis goes beyond traditional market sizing to examine the foundational technologies, supply chain requirements, and ecosystem development needed to realize these opportunities. We believe that understanding these deeper dynamics is crucial for identifying the most promising investments and creating enduring value as the Machine Economy takes shape. The opportunities we highlight share several critical characteristics:

- They contribute to the development of machine-to-machine commerce and interaction

- They leverage the convergence of multiple technological advances

- They create sustainable competitive advantages through network effects

- They have clear paths to widespread deployment and value creation

As we detail in the following chapters, we expect the next decade to see unprecedented growth in autonomous technologies, with several of our target sectors projected to reach trillion-dollar scale by 2043. However, our focus remains not just on market size but on building the fundamental infrastructure and capabilities that will enable the Machine Economy to flourish. This aligns with our broader mission of fostering transformative innovation that addresses critical global challenges while creating enduring economic value.

The emergence of the Machine Economy represents both an extraordinary opportunity and a crucial imperative. The companies we build today will create not just new technologies, but the very foundation of a new economic paradigm. This report serves as both an analysis of that opportunity and a blueprint for realizing its potential.

1.1. A World Transformed

By 2050, autonomy transforms every sector of the economy, weaving itself into the fabric of every industry, redefining the very essence of work, consumption, and innovation. The machine economy, fueled by interconnected autonomous systems, reshapes how we live, work, and interact, creating a future that thrives on intelligence, efficiency, and seamless integration. This is not an incremental shift but a seismic transformation where autonomous systems sense, decide, and act independently, driving profound changes across industries. The era of autonomy is not coming; it is here, and it is relentless in its reshaping of our world.

Communication Becomes the Nervous System

Communication networks operate as the lifeblood of the machine economy. Ultra-reliable, low-latency, and high-bandwidth systems power trillions of daily interactions between autonomous devices. 5G’s inadequacies have long been eclipsed by the capabilities of 6G and beyond, where decentralized networks, intelligent routing, and edge computing dominate. Quantum encryption secures the vast machine-to-machine (M2M) ecosystems, while self-healing communication grids ensure uninterrupted service in an interconnected world.

Consumption Evolves into Ecosystems

In the consumer realm, autonomy redefines products into adaptive ecosystems. Intelligent assistants anticipate needs, robotic companions enhance daily life, and autonomous transportation systems deliver unparalleled convenience. Hyper-personalized experiences become the standard, from AI-curated entertainment tailored to mood and preferences to home ecosystems that seamlessly integrate robotics, energy management, and communication. Consumption shifts from passive transactions to interactive relationships between users and their autonomous environments.

Supply Chains Operate in Hyperlogistics Mode

Autonomy eradicates inefficiencies in supply chains, embedding intelligence from raw material sourcing to last-mile delivery. Predictive AI aligns production with real-time demand, while drones and autonomous vehicles execute seamless, cost-effective deliveries. Hyperlogistics, characterized by fully autonomous warehouses and dynamic resource allocation, ensures companies can pivot instantaneously to market shifts. Waste reduction becomes a competitive differentiator, with sustainability integrated into automated operations.

Energy Powers and Adapts to the Machine Economy

Energy serves as both the backbone and challenge of the autonomous world. Power grids evolve into intelligent, self-regulating systems capable of balancing massive surges in demand from autonomous vehicles, data centers, and robotics. AI optimizes energy production and distribution in real time, integrating renewable sources into resilient microgrids. Advanced storage technologies, such as solid-state batteries and hydrogen cells, enable autonomy in remote and extreme environments.

Finance Automates at Scale

The financial sector shifts into overdrive, enabling decentralized, autonomous systems to manage resources and execute transactions at machine speed. Blockchain, though foundational in the early 2020s, gives way to more adaptive and scalable platforms. Autonomous agents negotiate contracts, allocate assets, and execute trades in real time, creating a decentralized financial ecosystem that operates without human intervention. Regulatory frameworks evolve to oversee these self-governing economic networks.

Healthcare Turns Predictive and Proactive

Healthcare transitions from reactive care to predictive, patient-specific interventions. Robotic surgeons operate with unparalleled precision, AI diagnostics deliver real-time insights, and telemedicine robots expand access to remote areas. Autonomous systems continuously monitor health metrics, intervening proactively to prevent complications. Personalized medicine reaches its zenith as autonomous drug delivery systems tailor treatments dynamically to individual needs.

Industry Embraces the Next Revolution

The industrial sector undergoes a paradigm shift, as autonomous factories reconfigure production lines dynamically and self-regulating supply chains operate with unparalleled efficiency. Autonomous construction equipment reshapes infrastructure development, while intelligent fleets revolutionize global logistics. Hypermobility and hyperlogistics blur the boundaries between production, transportation, and distribution, creating adaptive, real-time industrial networks.

Information Technology Becomes Omnipresent

IT emerges as the engine of the autonomous economy, enabling every other sector with advanced AI chips, decentralized computing, and robust cybersecurity. Edge computing processes data at the device level, reducing latency and enabling real-time decision-making. Quantum computing accelerates breakthroughs in AI and optimization, powering the increasingly complex autonomous systems that drive the global economy.

Materials Advance to Enable Autonomy

Materials science shifts focus to enabling autonomy itself. Lightweight composites make eVTOLs and drones more efficient, while self-healing alloys enhance the durability of robotics operating in extreme environments. Biocompatible materials transform medical devices and robotics, enabling new forms of human-machine interaction. Autonomous mining systems extract resources sustainably, and advanced recycling technologies close material loops, ensuring resource security for the future.

Real Estate Adapts to Intelligent Cities

Urban landscapes transform to accommodate autonomy. Smart roads guide autonomous vehicles, dynamic charging hubs replenish fleets, and urban air mobility networks reshape transportation. Fulfillment centers, optimized for hyperlogistics, dominate commercial real estate. Intelligent buildings self-regulate energy use, adapt to occupant needs, and integrate deeply into autonomous urban ecosystems. Cities that embrace these changes thrive as hubs of innovation and economic activity.

Utilities Innovate to Power a Machine-Driven World

Utilities evolve to meet unprecedented energy demands. Smart grids, integrated with AI, dynamically balance loads, optimize renewable energy, and predict maintenance needs. Decentralized microgrids enhance reliability and resilience, ensuring consistent service in a world dependent on autonomy. Public-private collaborations lead the way in building scalable, sustainable utility infrastructures that align with the demands of the machine economy.

1.3. Beyond the AI Hype

Expectations drive valuations, and hype amplifies those expectations. Navigating this dynamic requires a disciplined focus on opportunities that strike the right balance—neither too early to gain traction nor too late to avoid overvaluation. In today’s market, AI is at the center of both excitement and speculation. However, the widespread enthusiasm often obscures the practical realities of implementation and the realistic pathways to monetization. Our approach emphasizes investments rooted in long-term technological transformations that can sustain cash flows over decades rather than chasing near-term exuberance.

The AI Productivity Paradox

The Solow Paradox, named after economist Robert Solow, highlights a puzzling observation in the history of technological progress: despite the proliferation of computers and information technology, measurable productivity growth remained surprisingly stagnant. Solow famously quipped, “You can see the computer age everywhere but in the productivity statistics.” This paradox encapsulates the disconnect between rapid technological advancement and its delayed or uneven impact on economic productivity.

The core of the paradox lies in the gap between technological potential and its practical application. While new technologies offer unprecedented capabilities, realizing their productivity benefits often requires significant complementary changes, including organizational restructuring, workforce reskilling, and infrastructure adaptation. Without these changes, the technology itself may create more complexity than efficiency, offsetting its potential gains.

Historically, the Solow Paradox has been attributed to:

- Adoption Lags: It takes time for businesses and industries to integrate and optimize the use of new technologies.

- Measurement Issues: Traditional productivity metrics often fail to capture the intangible benefits of technological improvements, such as enhanced decision-making or customer satisfaction.

- Skill Gaps: The workforce must acquire new skills to effectively utilize advanced tools, which can create bottlenecks in realizing productivity gains.

- Displacement Costs: Technology often disrupts established processes, requiring significant short-term investment to achieve long-term gains.

Productivity, as we see it, is inversely proportional to two critical factors: (a) the rapid obsolescence of technology and (b) the technique required of users to unlock its potential.

Consider the life cycle of technological adoption: A user invests time and effort in mastering a particular system, only to find that their hard-earned expertise is rendered obsolete by the next version or iteration. This exponential decay in the utility of user skills has only accelerated in recent decades, affecting everything from consumer apps to industrial software. While AI, particularly machines that understand human language, promises to reduce this inefficiency, our experience suggests otherwise. Large language models (LLMs) and other AI tools often demand a new form of mastery—“prompt engineering,” troubleshooting, and integration skills—which themselves are rapidly becoming outdated as these tools evolve.

This perpetual learning curve erodes the net productivity gains AI promises to deliver. Moreover, the capital investments in AI infrastructure are unlikely to immediately yield the transformative productivity improvements many expect. Instead, the trend toward replacing human workers with autonomous agents will likely continue, but with mixed results. A significant proportion of these initiatives will fail to meet expectations, leading to waves of rehiring and reskilling across industries. This transitionary period, characterized by widespread displacement and unmet promises, is likely to exacerbate economic uncertainty and could contribute to recessions—or even depressions—as the gap between technological progress and practical utility grows.

AGI Skepticism is Healthy

Few ideas in AI have captured the imagination quite like Artificial General Intelligence (AGI). Yet, this concept, often equated with the ability of machines to generalize knowledge across vastly different domains, demands a reality check. By our definition, AGI embodies the "general intelligence" quality—a capability akin to a human who, trained to drive a car on Earth, could competently operate a lunar rover with minimal additional training.

Despite the bold claims of AGI’s imminent arrival, we see no evidence supporting a “magic leap” comparable to the transformer architecture that revolutionized machine learning. Instead, our base case is the emergence of "weak-AGI," characterized by models adept at complex reasoning and task performance but fundamentally limited in adaptability, creativity, and problem-solving. These systems, while powerful, will likely remain prohibitively expensive for all but the largest enterprises, restricting their application to the most high-value use cases.

Furthermore, the current deluge of capital investments in foundational model development cannot continue indefinitely. By late 2025 to mid-2026, we expect diminishing returns on invested capital (ROIC) to compel a shift toward optimization and efficiency rather than unbounded growth. This transition underscores the importance of infrastructure solutions, such as middleware platforms like Amazon’s Bedrock, which are already positioning to bridge the gap between foundational models and enterprise deployment.

The Long Road to ASI

Even more hyped than AGI is ASI, the concept of machine consciousness and the so-called singularity where machines surpass human intelligence in every domain. ASI, often portrayed as the ultimate endpoint of AI development, is in many ways the least tethered to present-day technological realities.

Our view is clear: ASI is not a serious proposition with today’s computational paradigms. We believe strong AGI—and by extension, ASI—requires properties and capabilities inherent in biological brains. Nature, over billions of years, engineered intelligence using wetware—organic, energy-efficient, and adaptive. If raw computational power through silicon were the optimal pathway to general intelligence, evolutionary processes would have leveraged it long ago. The inefficiencies of current silicon-based architectures make it clear that a fundamentally new computing paradigm is required—one that replicates the structure, energy efficiency, and adaptability of biological systems.

Such breakthroughs, while theoretically possible, are epochal in nature. Historically, technological leaps of this scale occur at intervals of 25 years or more. By our estimation, we are at least two to three major breakthroughs away from technologies that could enable ASI. These advances will likely emerge only after the current “frenzy” phase of autonomy subsides, when society begins to reconcile the impact of widespread automation and weak-AGI.

Moreover, the advent of reasoning-enabled large language models (LLMs) has opened the door to accelerating scientific development. These tools, while far from achieving AGI or ASI, could serve as catalysts for innovation in fields such as materials science, neuroscience, and computational theory—domains critical to the eventual realization of machine consciousness. However, even with these accelerants, the timeline for ASI remains measured in decades, not years.

A central challenge to achieving ASI is our lack of understanding of consciousness itself. Despite advancements in neuroscience and cognitive science, we still cannot definitively explain how or why consciousness arises in biological systems. Without this fundamental knowledge, replicating it artificially remains speculative at best. ASI, for all its hype, is thus less a near-term technological goal and more an intellectual exercise that highlights the limitations of our current understanding.

While ASI captivates the imagination, its speculative nature reinforces our focus on the tangible opportunities within the Machine Economy. The transformative potential of weak-AGI, autonomous systems, and machine-to-machine commerce is not contingent on achieving ASI. Instead, these technologies are already driving profound change by enabling machines to sense, decide, and act within specific domains. By aligning our investments with realistic, deployable technologies, we avoid the trap of chasing speculative endpoints and instead build the infrastructure for sustained economic value creation.

Ultimately, the hype surrounding ASI is symptomatic of a broader trend in the discourse around autonomy and AI. It’s a distraction from the immediate challenges and opportunities presented by weak-AGI and the Machine Economy. While we acknowledge the theoretical allure of ASI, our focus remains firmly on the practical, scalable advancements that will define the next decade of innovation.

Infrastructure is the Backbone of the Machine Economy

While much of the market’s attention remains on individual AI applications, we see the most enduring opportunities in the infrastructure that underpins the autonomous ecosystem. Edge computing, specialized hardware, and protocols for machine-to-machine commerce form the foundation for a future where autonomous systems can transact and interact independently. However, the current flood of capital into AI infrastructure is unsustainable. As the emphasis shifts to efficiency, foundational innovations will focus on maximizing the utility of existing systems, reducing costs, and enabling interoperability.

The Physical-Digital Convergence

If the digital revolution redefined how humans interact, the autonomous revolution is reshaping how machines interact with the physical world. This convergence of sensing, computation, and actuation creates opportunities for entirely new platforms and compounded network effects. Sectors like hyperlogistics, consumer robotics, and industrial automation stand to benefit from this integration, unlocking new frontiers of innovation and efficiency.

Data Networks and the Emergence of New Moats

The most successful autonomous systems will be those that create and leverage self-reinforcing data networks. Deployment generates data, which in turn improves system performance, enabling further deployment and reinforcing competitive advantages. Yet, we’ve been pleasantly surprised by the gains achievable with off-the-shelf models, validated data orchestration, and human-in-the-loop verification. This pragmatic architecture is emerging as the enterprise gold standard, where competitive advantage increasingly lies not in the AI model itself but in the art and science of managing automated workflows.

Dissecting Markets and Supply Chains

The Machine Economy will not emerge in a vacuum. It will be built on the back of existing systems, many of which must be overhauled, integrated, or entirely replaced. Understanding these dynamics involves dissecting supply chains to identify where autonomy and AI can create the most value, anticipating bottlenecks, and developing solutions to optimize the flow of resources and information. This kind of granular analysis is critical to ensuring that the deployment of autonomous systems results in real-world efficiency gains rather than theoretical potential.

Evaluating Technology, Startups, and Consumer Needs

Innovation is not uniform, and not every advancement will contribute meaningfully to the Machine Economy. A consistent, systematic process for evaluating the state of technology, the viability of startups, and the evolving demands of consumers is essential. This process must look beyond the surface-level hype to understand the fundamental value proposition of new technologies, their scalability, and their ability to address pressing market challenges. Equally important is anticipating shifts in consumer behavior as autonomy reshapes how individuals and businesses interact with technology.

The Imperative for Patient Capital

The rapid pace of technological advancement often creates a false sense of urgency. Yet, the kind of transformation we are pursuing is not achieved through short-term wins or speculative bets. It requires patience—both in the development of technologies and in the deployment of capital. Building the infrastructure, ecosystems, and capabilities that underpin the Machine Economy will take years, if not decades. Success will come to those who are willing to commit to this timeline, avoiding the pitfalls of overexuberance and embracing the steady, deliberate process of innovation.

The Machine Economy demands patient capital—investment strategies that prioritize long-term value creation over short-term returns. This approach involves not just funding innovation but nurturing it, providing the resources, guidance, and stability that startups and innovators need to scale responsibly. Patient capital aligns with the broader mission of fostering transformative technologies that address critical global challenges, ensuring that the economic value created is both enduring and impactful.

Building the Foundation

The Machine Economy represents an extraordinary opportunity, but it is one that must be approached with clarity, discipline, and a willingness to embrace the long view. Transformation of this magnitude is not about chasing the latest trend; it is about laying the groundwork for a new economic paradigm. By methodically dissecting markets, aligning with sustainable technological shifts, and committing to patient capital, we can navigate the hype and build the infrastructure for a future defined by autonomy, intelligence, and interconnected value creation.

Above all, it is a process that rewards those who understand that true innovation is not about speed but precision, and that the greatest returns come not from following the crowd but from leading it thoughtfully and deliberately. This is the blueprint for realizing the potential of the Machine Economy—and the imperative for those who seek to shape it.

1.4 Venture Capital Trends

The venture capital market entering 2025 reflects a fundamental transformation in how technology companies are funded and built. Deal activity in 2024 surpassed pre-pandemic levels but remained well below the peaks of 2021-2022, with total venture investment showing signs of stabilization. However, this apparent stability masks a dramatic bifurcation in the market that began to emerge in late 2024.

A small number of companies building foundational technologies for artificial intelligence and autonomous systems have attracted unprecedented capital, with deals like CoreWeave's $8.6 billion Series C and xAI's $6.0 billion Series B driving overall market metrics. Meanwhile, more traditional venture investments face increased scrutiny, longer fundraising cycles, and declining valuations. This divergence is particularly evident in deal sizes, where the gap between median and average investments has reached historic levels, demonstrating the market's increasing concentration.

The structural transformation of venture capital is most apparent in fundraising dynamics. In 2024, just nine venture capital firms accounted for 40% of all U.S. fundraising, marking the highest concentration of capital in a decade. For the first time, established funds outnumbered emerging funds, while the median time between funds has stretched back to three to four years from a low of two to 2.5 years in 2021. This consolidation has profound implications for capital access, with first-time financings hitting multi-year lows and pre-seed/seed rounds reaching their lowest relative share in ten years.

The exit environment further illustrates the market's structural challenges. While the number of exits remains on pace with pre-2021 figures, large, return-generating exits have become increasingly rare. More than 40% of U.S. unicorns have now been trapped in portfolios for over nine years with no clear path to liquidity. This has created a self-reinforcing cycle where limited partners, facing a historic scarcity of distributions comparable to levels seen during the global financial crisis, have become increasingly hesitant to make new venture commitments.

Valuation dynamics reflect these broader trends. Down rounds climbed to nearly 25% of all financings by mid-2024, particularly at the late stage, while the time between rounds for all series hit decade highs. However, top-quartile valuations across stages have begun recovering toward pre-pandemic levels, creating a widening divergence between top-quartile and median valuations that further demonstrates the market's bifurcation.

The role of crossover investors has also evolved significantly. While their overall participation in venture deals has declined from peak levels, these investors have become increasingly strategic, focusing on late-stage companies building fundamental infrastructure for the next wave of technology. Their long-term investment theses have allowed them to add capital to selected ventures even as traditional venture investors have pulled back.

This transformation of the venture capital landscape coincides with unprecedented investment in artificial intelligence and autonomous systems infrastructure. The massive capital requirements and extended development timelines of these technologies are fundamentally misaligned with traditional venture models optimized for rapid scaling of software companies. This misalignment, combined with the broader structural changes in venture capital, suggests we are entering a new epoch that demands new approaches to technology investment and company building.

1.5. Forecasting

We take the position that the future is unknowable. Given that, why forecast? Let us remember the purpose of a forecast is to understand the potential. We're well aware our forecasts will be off, sometimes by wide margins. The point is to get a compass bearing to find true north, and to take new bearings as the market unfolds. The purpose is to set our expectations and adjust expectations to new information as it becomes available. In the end, the goal is to be less wrong, and maximize our chances for returns by being situationally aware. With this in mind, we take our own forecasts worth the requisite grain of salt. You should too.

We attempt to build an edge into our investments based on modeling the specific cash flows of every company we decide to engage or invest in. Our forecasting methodology typically combines both top-down and bottom-up approaches, recognizing that each provides vital perspective in navigating the Machine Economy's emergence. The top-down view allows us to understand macro trends, technological convergence points, and potential market sizes. This helps establish the broader context and opportunity landscape. Meanwhile, our bottom-up analysis examines specific use cases, technology readiness levels, and granular market dynamics. This dual approach creates a more complete picture, helping us identify not just the size of opportunities, but their timing and prerequisites for success.

We pay particular attention to non-linear effects and compounding factors in our forecasts. The Machine Economy is characterized by network effects, feedback loops, and exponential growth patterns that can accelerate or impede adoption in ways that linear projections often miss. Our models explicitly account for these dynamics, incorporating factors such as technology learning curves, ecosystem network effects, and regulatory feedback loops. This approach helps us identify potential tipping points where gradual progress might suddenly accelerate, as well as barriers that could create unexpected delays or pivots in market development.

Perhaps most importantly, we view forecasting as an iterative process rather than a one-time exercise. Our models are living documents, continuously updated as new data emerges and market dynamics evolve. This adaptive approach allows us to maintain strategic flexibility while building deep conviction in long-term trends. When combined with our patient capital approach, this creates a powerful framework for identifying and capitalizing on the most promising opportunities in the Machine Economy—even as the specific path to realizing them may differ from our initial expectations.

2.0. Our Investment Philosophy

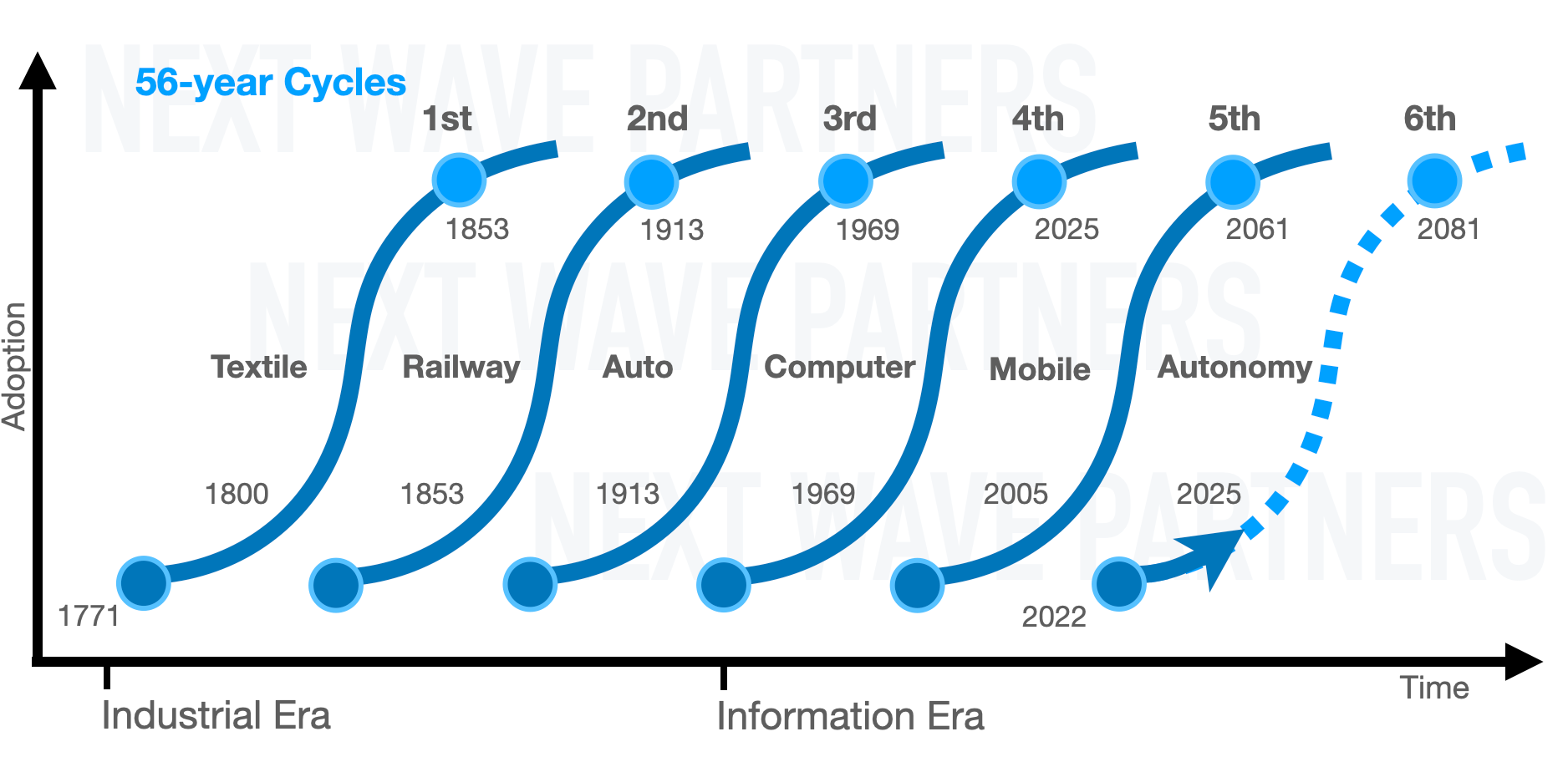

Throughout history, transformative technological waves have revolutionized society and reshaped the global economy. The first wave, beginning in the 1780s, harnessed steam power to mechanize production, particularly in textiles, creating the first factories and establishing the foundations of industrial capitalism. The second wave, marked by railways and steel production in the 1850s, enabled mass transportation and connected markets across continents. The third wave, starting in the 1900s, brought electrification to homes and factories, while advancing chemical manufacturing and creating entirely new industries. The fourth wave, from the 1940s through the 1990s, ushered in mass production through automobiles, petrochemicals, and aerospace advances, democratizing personal transportation and creating the modern consumer economy. The fifth wave, beginning in the 1990s, digitized our world through personal computers, the internet, and mobile devices, connecting humanity and creating trillion-dollar technology companies by digitalizing commerce, communication, and entertainment.

Each successive wave has built upon and amplified the capabilities created by its predecessors. Steam power enabled the mass production of steel, which enabled the construction of electrical infrastructure, which powered the assembly lines of the fourth wave, which manufactured the computers that drove the digital revolution. Today, we stand at the dawn of the sixth long wave of innovation: the Era of Autonomy.

This new wave represents a fundamental departure from previous technological revolutions. While earlier waves primarily augmented human capabilities—making us stronger, faster, or better connected—the Era of Autonomy creates truly independent machine actors capable of sensing, deciding, and acting in the physical world. Autonomous systems range from industrial robots that adapt their operations in real-time to vehicles that navigate complex environments without human intervention. Intelligent infrastructure embeds computing power and decision-making capabilities directly into our physical environment, creating self-aware systems that can respond to and anticipate both human and machine needs. Machine-to-machine commerce enables direct economic interaction between autonomous systems, creating new markets that operate at machine speed and scale.

This transformation transcends simple automation or digitization. It represents the emergence of a new technological paradigm where machines become independent participants in economic and social systems. Just as the internet created trillion-dollar companies by digitizing human interactions, this wave will create equal or greater value by digitizing and automating the physical world itself. The result is a self-reinforcing cycle of innovation and economic activity: autonomous systems generate data that improves their performance, intelligent infrastructure enables more sophisticated autonomous operations, and machine-to-machine commerce creates economic incentives for further advancement.

2.1 Theoretical Framework

Understanding this moment requires situating it within the frameworks of Joseph Schumpeter's theory of creative destruction and Carlota Perez's analysis of technological revolutions and financial capital. Schumpeter argued that innovation clusters periodically disrupt existing economic structures, dismantling old industries while giving rise to new ones. Perez extended this idea, emphasizing the cyclical nature of technological revolutions and how they unfold in distinct phases: installation, turning point, and deployment. Each wave begins with a surge of innovation, followed by a speculative frenzy as financial capital seeks to profit from early opportunities. This is often accompanied by instability as new paradigms clash with legacy systems. The turning point comes when institutional frameworks adapt to the new technology, enabling a deployment phase where innovations diffuse broadly, transforming society and creating sustained economic growth.

The Era of Autonomy reflects this cyclical pattern. During installation, breakthrough technologies like artificial intelligence, advanced robotics, and edge computing emerged as independent innovations. We are navigating a turning point, marked by intense speculation in areas like autonomous vehicles and generative AI, alongside economic and regulatory adjustments as these technologies integrate into existing systems. Perez's framework suggests that if this turning point is managed effectively—by aligning financial capital, regulatory policies, and societal needs—the deployment phase will unleash widespread productivity gains, redefine industries, and foster economic stability.

What makes this wave unique is its unprecedented scope of technological mediation. Philosopher Don Ihde identified four fundamental ways technology shapes human experience:

Hermeneutic mediation transforms how we interpret and understand the world, as autonomous systems provide new ways of sensing, analyzing, and making sense of our environment.

Alterity mediation changes how we interact with technology as an independent actor, as autonomous systems become increasingly sophisticated partners and counterparts in human activity.

Embodiment mediation extends human capabilities, as autonomous systems augment our ability to act in and upon the world.

Background mediation reflects how technology shapes our environment, as intelligent infrastructure creates responsive, adaptive spaces that anticipate and meet both human and machine needs.

The Era of Autonomy represents the first time in human history that a single technological wave engages all four dimensions simultaneously. As these systems mature and fade into the background of daily life, they will fundamentally restructure how humans live, work, and interact with their environment. This comprehensive transformation creates extraordinary opportunities for value creation while demanding careful consideration of societal impact.

Our thesis is to align with these dynamics, recognizing that the long-wave patterns identified by Perez guide how and where value is created in this transformation. By investing in the foundational technologies of this wave, embedding intelligence into infrastructure, and fostering machine economies, we position ourselves to both influence and benefit from the next great phase of economic and technological evolution.

2.2 Development and Diffusion

The autonomous era unfolds through three major technological domains—Human Augmentation, Robotic Autonomy, and the Machine Economy—that develop in parallel and reinforce each other through complex feedback loops. Rather than progressing linearly, advances in each domain create opportunities and accelerate development in the others. Understanding these interdependencies helps us target technologies that can catalyze progress across multiple domains simultaneously.

Human Augmentation

Human Augmentation technologies enhance human capabilities through artificial intelligence and advanced interfaces. This domain now critically includes Large Language Models (LLMs), generative AI, and early reasoning systems. LLMs are rapidly improving human-computer interaction through natural language understanding and generation. Generative AI tools are boosting productivity across a wide range of creative and analytical tasks by automating content creation, code generation, and design processes.

Early reasoning systems, although still nascent, are beginning to demonstrate the ability to perform logical inference and problem-solving, extending human cognitive capabilities. These advancements, alongside computer vision and other AI-driven tools, generate valuable training data and create validation environments for autonomous systems while simultaneously creating immediate value through improved human productivity.

For example, computer vision systems developed for augmenting human decision-making provide crucial data and validation for fully autonomous operations, while advances in autonomous systems often feed back into better augmentation technologies. Similarly, the data generated and processed through human interaction with LLMs and generative AI can be used to improve the training of autonomous systems.

Robotic Autonomy

Robotic Autonomy focuses on systems that can operate independently in real-world environments, performing tasks without direct human control. This domain encompasses both the physical Actuation & Motion systems and the Sensing & Perception capabilities, as well as the AI & Software that enables intelligent decision-making. Advancements in Electronics & Computing, such as more powerful processors and specialized AI chips, are critical for enabling on-board processing and real-time control.

Progress in this domain is symbiotic with Human Augmentation, as autonomous systems generate data that improves human-machine interfaces, including those powered by LLMs. Moreover, advancements in Human Augmentation create new interaction paradigms and control mechanisms for robotic systems. Robotic Autonomy also has a mutually beneficial relationship with the Machine Economy. Autonomous systems create new requirements for machine-to-machine interaction, driving the development of protocols and infrastructure for the Machine Economy.

In turn, a robust Machine Economy facilitates the coordination and resource allocation necessary for complex autonomous operations, enabling fleets of robots to work together seamlessly and transact for resources. The deployment of autonomous systems also reveals gaps in current capabilities, directing investment toward critical enabling technologies across the entire supply chain, particularly in areas like robust Materials & Mechanical Structure for diverse environments, improved Energy Storage and Power Systems and advanced Communication Systems for untethered operation.

Machine Economy

The Machine Economy envisions a future where intelligent systems can interact and coordinate with each other autonomously to accomplish tasks, allocate resources, and achieve shared goals. This goes beyond simple economic transactions to encompass dynamic Machine-to-Machine (M2M) communication, negotiation, and collaboration.

This domain is enabled by advancements in AI, distributed ledger technologies (like blockchain), smart contracts, and decentralized autonomous organizations (DAOs). The need to coordinate autonomous systems, such as fleets of robots in a warehouse or autonomous vehicles on the road, is driving the development of early M2M capabilities. These developments, in turn, enable more sophisticated and decentralized autonomous operations, reducing reliance on centralized control and creating new opportunities for human-machine collaboration. For example, autonomous robots could dynamically negotiate for cooperative action, energy, maintenance, or data access with other machines, optimizing their performance and contributing to the overall efficiency of the system.

Progress in the Machine Economy will be particularly dependent on advancements in AI & Software for enabling autonomous decision-making and negotiation, robust and secure Communication Systems for reliable M2M interaction, and Electronics & Computing for handling the complexities of decentralized networks and distributed intelligence. The Machine Economy also benefits from, and will further drive, advancements in Robotic Autonomy by creating an ecosystem where autonomous systems can seamlessly interact and collaborate.

Coherence

Across these interconnected domains, we target technologies that:

- Create compound network effects by enabling capabilities across multiple domains

- Generate valuable data assets that improve system performance over time

- Reduce friction in deploying and scaling autonomous systems

- Enable secure and reliable machine-to-machine interaction

- Address critical gaps in autonomous system capabilities

This systems-level view of technological development helps ensure our investments catalyze progress across the entire autonomous ecosystem while maintaining focus on near-term value creation. By understanding how advances in each domain reinforce and accelerate development in others, we can identify investments that both contribute to the broader transformation and capture significant value in current markets. The key is recognizing that progress rarely follows a linear path. Breakthroughs in any domain, particularly in the rapidly advancing fields of LLMs, generative AI, and early reasoning systems, can unlock unexpected opportunities across the entire ecosystem. Our investment approach therefore maintains flexibility to capture value wherever it emerges while ensuring our portfolio companies benefit from advances across all domains.

2.3 Definition of Focus

Our investment thesis centers on technologies enabling autonomous systems, intelligent infrastructure, and machine-to-machine commerce. These innovations exploit and extend the foundations established in the fifth wave—ubiquitous computing, telecommunications, and data analytics—to create systems capable of independent sensing, decision-making, and action in the physical world.

Our investment focus in 2025 centers on three interconnected domains that we believe will form the foundation of the autonomous economy:

Autonomous Systems encompass technologies that enable machines to independently sense, decide, and act in the physical world. We target innovations in advanced robotics, computer vision, sensor systems, and artificial intelligence that allow machines to operate effectively in complex, unstructured environments. This includes industrial automation systems that can adapt to changing conditions, autonomous vehicles that safely navigate dynamic environments, and robotic systems that can work alongside humans in fields ranging from healthcare to agriculture.

Intelligent Infrastructure represents the integration of autonomous capabilities directly into our built environment. This includes smart electrical grids that automatically balance supply and demand, buildings that optimize their own energy usage and maintenance, and transportation systems that dynamically adjust to changing conditions. These systems create a self-aware physical environment that can respond to and anticipate both human and machine needs while dramatically improving efficiency and resilience.

Machine-to-Machine Cooperation focuses on technologies that enable direct economic interaction between autonomous systems. This includes platforms for automated resource allocation, protocols for machine-to-machine cooperation, and systems that allow autonomous agents to negotiate and execute operations and transactions. We target innovations that create new markets for machine-mediated services and enable efficient coordination between autonomous systems at scale.

We particularly value opportunities where these domains intersect, creating compound network effects and establishing new platforms for innovation. Our investment approach emphasizes technologies that can scale across multiple industries while maintaining robust security, reliability, and performance characteristics.

2.4 Focus on Societal Benefit

This unprecedented technological convergence creates extraordinary opportunities for value creation, but also demands careful consideration of societal impact. Many of these technologies have the potential to either significantly benefit or harm society, depending on how they are developed and deployed. Our investment approach therefore prioritizes:

- Solutions that enhance human capability rather than replace human agency

- Technologies that promote resilient and sustainable industrial systems

- Innovations that democratize access to technological benefits

- Developments that strengthen rather than weaken societal institutions

We believe the most valuable companies in this wave will be those that successfully navigate these imperatives while delivering transformative capabilities. By focusing on technologies that create clear societal benefits while building robust business models, we position our portfolio to capture extraordinary returns while promoting positive technological progress.

This approach requires deep technical expertise, sophisticated operational capabilities, and patient capital aligned with longer development timelines. It also demands careful attention to potential negative externalities and active engagement with regulatory and ethical frameworks. We believe this comprehensive approach to value creation is essential for successfully investing in technologies that will reshape civilization itself.

2.5 Venture Capital’s Role

Venture capital has historically served as the key enabler of technological revolutions, providing the risk capital and operational expertise needed to transform breakthrough innovations into world-changing companies. The semiconductor revolution, personal computing, and the internet were all accelerated by venture capital's unique ability to identify promising technologies, support visionary founders, and provide patient capital for long-term development. This model was essential in driving the technological waves that have transformed our economy and society.

However, profound changes in the venture capital industry over the past two decades threaten its ability to fulfill this crucial function for the autonomous era. The industry has become increasingly concentrated, with just nine firms now controlling 40% of all U.S. fundraising. This consolidation has created a system that prioritizes short-term valuation growth over sustainable value creation, pushing companies toward unsustainable growth trajectories while concentrating returns among a small group of insiders.

The consequences of this transformation are particularly problematic for autonomous technology companies, which require patient capital and sophisticated operational support to develop complex technologies and bring them to market. The traditional venture model, with its 10-year fund lifecycle and emphasis on rapid scaling, is poorly suited to the longer development timelines and capital-intensive nature of autonomous technology development.

The industry's current structure creates a self-reinforcing cycle that undermines innovation. Early investors and founders, who take the greatest risks, often find themselves heavily diluted by later rounds that prioritize growth over sustainability. The pressure to achieve unicorn status drives companies to pursue unsustainable growth strategies rather than building lasting value. Meanwhile, the public markets, once a crucial source of growth capital for young companies, have been largely closed off—the number of public companies has halved since the dotcom era.

To unlock the full potential of the autonomous era, venture capital must return to its roots while evolving to meet new challenges. This means:

- Creating investment structures that align incentives around sustainable value creation rather than speculative valuations

- Providing patient capital that matches the development timelines of complex technologies

- Building deep operational expertise to support sophisticated technology development

- Fostering strategic partnerships that accelerate commercialization

- Ensuring early risk-takers share appropriately in the value they help create

When properly structured, venture capital can still serve its essential function as a catalyst for technological revolution. The key is developing investment frameworks that support the patient, focused development required to bring transformative technologies to market while ensuring the rewards of innovation are broadly shared. This alignment of interests—among founders, investors, and society—is crucial for realizing the full potential of the autonomous era.

The venture capital industry must evolve to meet this moment. The autonomous revolution represents perhaps the most significant technological wave in human history, with the potential to transform every aspect of how we live and work. Capturing this opportunity requires a fundamental reimagining of how venture capital supports innovation—one that emphasizes sustainable value creation over short-term gains and aligns the interests of all stakeholders in service of long-term transformation.

3.0. The Machine Economy Opportunity

Introduction

We are on the cusp of a profound technological shift, a transition to an era defined by the Machine Economy. This is not merely an incremental advancement in automation, but a fundamental reimagining of economic activity, driven by interconnected, intelligent, and increasingly autonomous machines. Imagine a world where machines not only communicate and coordinate but also transact, negotiate, and collaborate with each other, forming dynamic, self-organizing systems that operate with minimal human intervention. This is arguably the most ambitious and forward-looking technological vision of our time, with the potential to be the most profound and transformative development since the internet itself.